It’s that time of the year when most Indians residing in the US are searching for whether and how to file tax returns online. The first question – do you even have to file taxes – is easy. The answer is yes, probably even if you are not a U.S. citizen.

If the government considers you a US tax resident (more on this later), then you have to report all income earned to the IRS and pay taxes. However, that does not automatically mean that your income will be taxable. You’re simply reporting it to the United States government.

The second question – how to file tax returns – is trickier. So, here’s a cheat sheet that tells you all you need to know about filing returns.

How to File Tax Returns Online for 2022?

The tax season begins on Monday, January 24, 2022. From that date, all permanent residents and tax residents can start filing their taxes. Also, even if you aren’t considered a tax resident, it is a smart idea to file them anyway. Why? You might qualify for a tax credit or be able to claim a refund.

Do green cardholders have to pay taxes?

Yes, all green card holders are US tax residents. They need to report all income and pay taxes, whether earned in the US or internationally. You must file tax returns using the IRS Form 1040 by April 15, 2022, even if you haven’t stayed in the US all year.

What about nonimmigrant visa holders?

If you’re in the US on a nonimmigrant visa, you may have to file taxes, depending on whether you’ve passed the Substantial Presence Test (SPT). The test declares that a nonimmigrant visa holder who has spent 31 or more days in the US in the current year is a tax resident.

You’re also a tax resident if you spend 183 days (calculated using a weight system) in “the current year and the two years immediately before that.”

As green card holders, all nonimmigrant visa holders use IRS Form 1040 to file taxes, and they have to do it by April 15th. The difference is that they only report income earned in the US. No taxes need to be paid for earnings outside the country.

If you’re not a green card holder or haven’t passed the Substantial Presence Test, this official site lists all the possibilities where you may have to report income. If you’re an H1B visa holder, here’s a complete guide on how to file your taxes.

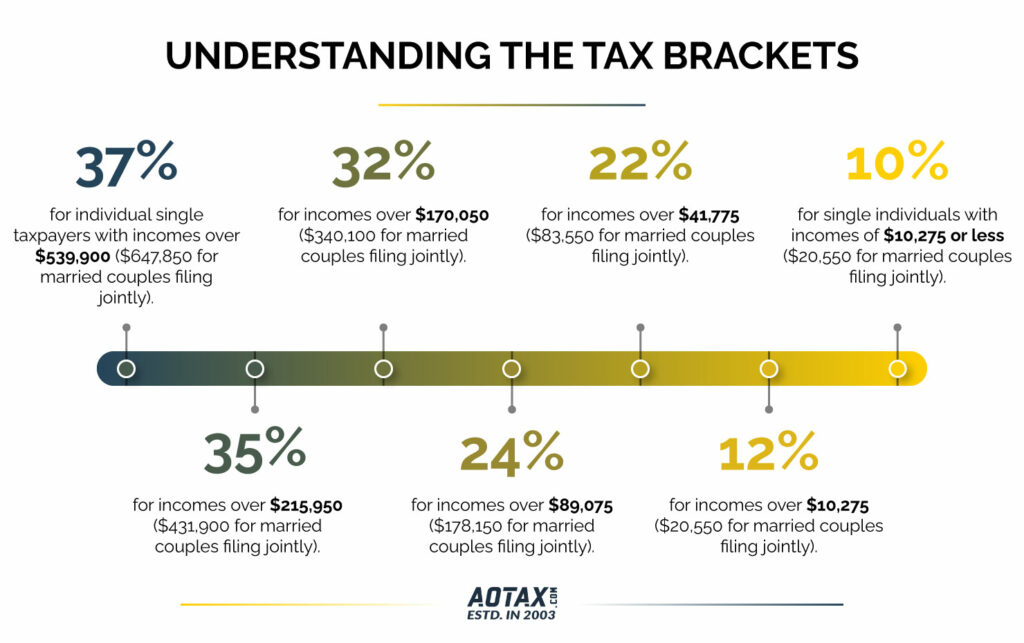

Have a Basic Understanding of Tax Brackets

The US government uses a progressive tax system, so people with lower taxable income pay fewer taxes, and those with higher income pay more. So, how does the US calculate how much tax you need to pay? By dividing your income into tax brackets. Each bracket has its corresponding tax rate, and for this year, it is:

- 37% for individual single taxpayers with incomes over 539,900 ($647,850 for married couples filing jointly).

- 35%, for incomes over $215,950 ($431,900 for married couples filing jointly).

- 32% for incomes over $170,050 ($340,100 for married couples filing jointly).

- 24% for incomes over $89,075 ($178,150 for married couples filing jointly).

- 22% for incomes over $41,775 ($83,550 for married couples filing jointly).

- 12% for incomes over $10,275 ($20,550 for married couples filing jointly).

- 10% for single individuals with incomes of $10,275 or less ($20,550 for married couples filing jointly).

The benefit of a progressive system is that the tax rate does not apply to your entire income, irrespective of which bracket you fall into.

Pick how to file your tax return

You can file tax returns online, by hand, or hire a tax preparer. Filling out the Form 1040 manually and then emailing it is not a great idea because the process is much, much longer.

If you expect a refund, filing taxes online is better because the IRS processes e-filed returns faster. There is plenty of tax software that makes it very convenient.

The third option is to hire someone who provides tax preparation and filing services. You should strongly consider it if you are filing taxes for the first time, have never prepared tax returns using software, or have a complicated revenue stream. Professional guidance is crucial in the last instance.

Say you have a business that makes your finances complicated, or you also earn through a side gig, then a professional would make it easier to understand which forms are required, what common deductions to factor in, etc.

Collect all your documents

The last step before you sit down to file your tax returns online is to gather all your documents. You will need an ITIN, which is an individual taxpayer identification number. It’s issued by the IRS to people who do not have a Social Security number (SSN). You will also need to gather all:

- Proof of income.

- Proof of taxes already paid.

- Proof of expenses to get tax credit or deductibles.

Swing by here for all the documents and forms you’ll need to file your taxes online (or get them done by professionals).

How to File Tax Returns Easily and Without Worry?

Filing taxes is never easy. But it becomes a daunting task the minute you get your provisional (and later permanent) green card. After that, you have to report all your income earned anywhere globally, even if you don’t spend a day in the US throughout the year.

For tax purposes, the US considers you their resident. It’s also a laborious task for Indians who have just gone to the US and filed their returns for the first time.

At AOTAX, we help Indians living in the US file their tax returns online. We’ve been doing this for a decade and a half with the help of an expert and qualified professionals. Besides tax preparation and filing services, we also offer tax planning advice, ITIN processing services, and extension filing. The entire process is online, making it effortless for you while ensuring you get the maximum returns possible! With AOTAX, you get to rest assured that your taxes are done right. Sign up and file tax returns online!

Recent Comments