As an NRI in the US, if your business is affected by the Coronavirus, these 3 credits can be of help

As an NRI in the US, if your business is affected by the Coronavirus, these 3 credits can be of help

The pandemic COVID-19 has had a disastrous impact on the economic lives of the people in the US. The NRIs in the US who are having their businesses have incurred huge losses and many are even on the verge of being shut down either temporarily or permanently. Coronavirus In such difficult times, the Internal Revenue Service (IRS) has introduced three different and new credits which would be helpful for the business owners and their employees as well.

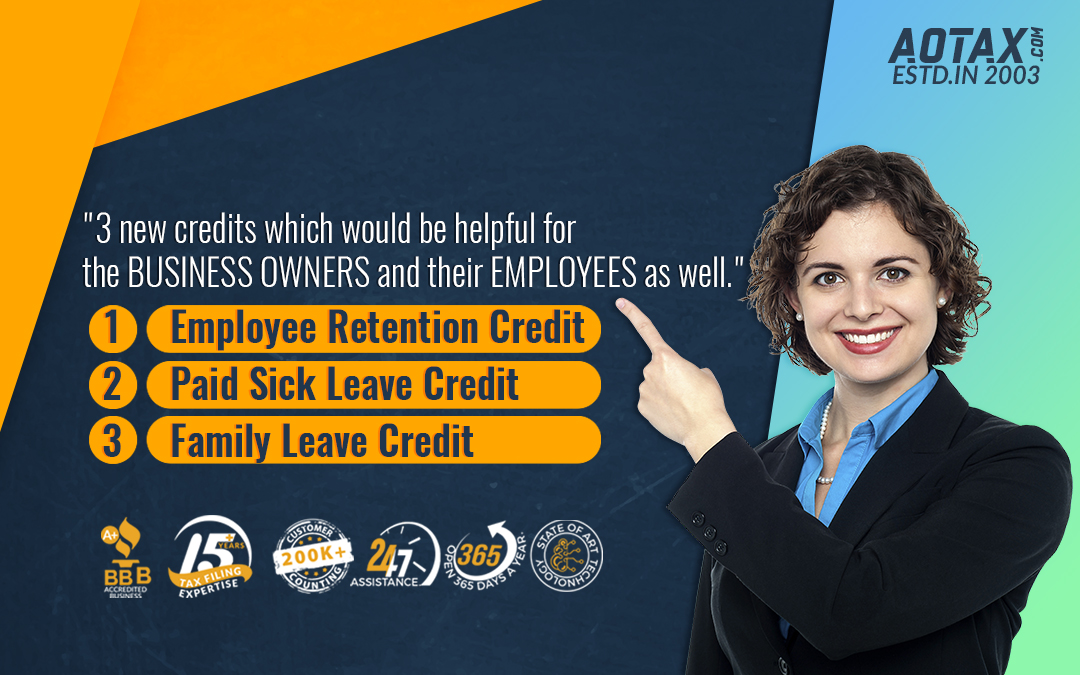

- Employee Retention Credit

- Paid Sick Leave Credit

- Family Leave Credit

The Internal Revenue Service (IRS) has introduced three different and new credits which would be helpful for the business owners and their employees as well.

Employee Retention Credit

1. The major objective behind the design of the Employee Retention Credit is to motivate various businesses to continue keeping their employees on their payroll rather than opting for a lay-off.

2. The Employee Retention Credit would be in the form of refundable tax credit which is 50% of up to $10,000 in wages which are paid by a business owner whose business has been affected due to the outbreak of COVID-19.

3. All business owners inclusive of those organizations which are tax-exempt are eligible to avail this credit irrespective of their sizes.

4. Any business owner whose business has undergone suspension either completely or partially due to COVID-19 is eligible to avail the Employee Retention Credit.

5. Moreover, an employer or a business owner would receive the Employee Retention Credit until the gross receipts of his business are below 50% of the comparable quarter of 2019. However, once the gross receipts are increased to 80% of a comparable quarter of 2019 then the business would no longer receive this credit.

6. Small businesses who might be taking small business loans and other State/Local Government instrumentalities are not eligible for availing the Employee Retention Credit.

Paid Sick Leave Credit

1.Paid Sick Leave Credit would enable businesses to obtain credit for those employees who are unable to work during COVID-19 due to either being self-quarantined or exhibiting symptoms of COVID-19 and are under medical supervision.

2. These employees would be paid sick leave credit for up to 10 days which is equivalent to 80 hours. This credit would be paid at the regular rate of up to $511 per day and $5,110 in total.

3.Those employees who work on a part-time basis would be eligible for receiving paid sick leave based on the number of hours the employee works on an average in two weeks.

Family Leave Credit

1.Business owners or employers would receive credit for those employees who are not able to come to work due to the need for taking care of family member who has been affected by the Coronavirus or due to need for taking care of a child who is below the age of 18 years whose school/daycare is being closed due to the pandemic.

2.These employees are eligible to avail paid sick leave for up to 80 hours i.e. up to two weeks at the rate of 2/3 of his regular pay or up to $200 each day i.e. $2000 in total.

3.Employees can also receive paid family leave and medical leave which is equal to 2/3 of the regular pay obtained by the employee that is up to $200 each day and resulting in $10,000 total. Family leave credit can be calculated towards up to 10 weeks of qualifying leave.

How can business owners/employers obtain credit?

How can business owners/employers obtain credit?

1.The business owners/employers can immediately obtain the entire amount of sick leave credit and family leave credit along with the expenses involved in health care plans plus the employer’s share of the Medicare tax on the leave for the period ranging from 1st April 2020 to 31st December 2020.

2.The business owners would be able to reimburse these credits immediately by making a reduction in their required deposit of payroll taxes which have been withheld from the wages of the employees by the credit amount.

3.Those business owners who are eligible to obtain these credits can report about their total qualified wages and the costs incurred in health insurance for each quarter either by filing Form 941 or by filing their quarterly employment tax returns.

4.In case, the tax deposits of a business owner are not sufficient enough to cover the credits then the owner can receive an advance payment by submitting Form 7200 with the IRS.

Hence, these credits would be of immense help to the NRI business owners to support their employees during this difficult economic period caused by the pandemic.

References

https://www.irs.gov/newsroom/irs-three-new-credits-are-available-to-many-businesses-hit-by-covid-19

https://www.dol.gov/newsroom/releases/osec/osec20200320

https://www.foxrothschild.com/publications/irs-issues-guidance-on-tax-credits-for-required-paid-leave-under-ffcra/

Recent Comments