Tax relief measures for small businesses during the coronavirus pandemic

Tax relief measures for small businesses

during the coronavirus pandemic

The entire nation has been affected by the dreadful coronavirus. The rapid spread of the COVID-19 across the country has affected the economy on a very massive scale. The business operation across the country has come to a standstill especially in the case of small businesses that are tax relief measures. Social distancing and quarantining have led to a decrease in the number of customers coming to purchasing impacting sales. Numbers of employees are also not going on work as everyone is forced to stay inside for preventing further spread of the disease. In such adverse situations where there are huge economic disruptions, the Government is working towards passing legislation that would help in providing financial relief to the businesses and taxpayers.

The Families First Coronavirus Response Act

On March 13th, 2020, President Trump had declared a situation of national emergency along with open access of States and Territories to $50 billion for the shared fight against the disease. Again on 18th March 2020, the Senate had passed the Families First Coronavirus Response Act. This bill was signed by the President on that day which included the below-mentioned highlighted points.

1.Federally mandated paid leave benefits and paid sick leave are to be provided to the eligible employees. The paid sick leave must be provided to the impacted employees for 14 days at the regular rate of pay i.e. max $511 per day. Moreover, employers should also provide the benefits of paid leave to the eligible employees for three months.

2.The availability of tax credits for both employers and self-employed taxpayers have been mandated to reduce the burden of employers arising due to the paid leave

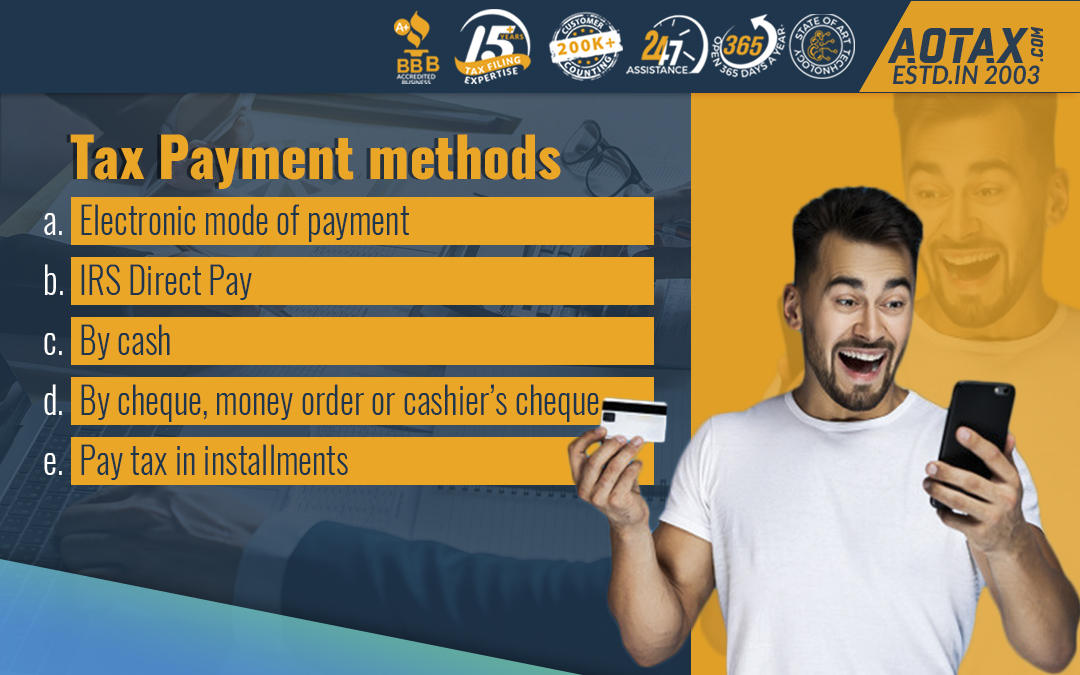

Extension in tax payment and tax return filing deadline

The US Treasury Department and the IRS had announced that the deadlines for filing tax returns and tax payments that are due on 15th April 2020 are extended up to 15th July 2020. This extension is applicable for making filing tax returns for 2019, Income Tax payments for 2019 and the estimated income tax payments for 2020.

If there is a tax refund due, then the Income tax returns must be filed as soon as possible so that the refund can be obtained immediately and put to use in this time of crisis.

Low-interest loans guaranteed by the SBA

When there is a tremendous drop in sales, it becomes quite difficult to manage business expenses, employee wages, bills, etc. In such a situation, a business loan can be taken but then it will have a very high rate of interest. So, to ease down these worries the President has announced that the Government would provide more funds in the federal disaster loans which are backed by the Small Business Administration (SBA). The loans provided by the SBA are known as the Economic Injury Disaster Loan.These loans would help in providing relief for the qualifying businesses in the below-mentioned forms.

- Loans at low-interest rates i.e. 3.75% for businesses and 2.75% for non-profit organizations.

- Repayment plans are long term in nature i.e. up to a maximum period of 30 years.

If a small business is facing financial issues and is not able to afford bills related to the payroll expenses, fixed debts and accounts payable then it can apply for an “Economic Injury Disaster Loan”.

Moreover, the federal and state financial regulators have been encouraging the financial institutions to work in a co-operative manner with those borrowers who belong to the affected communities.

Cash Payment by the Government

Another measure taken by the Government to provide relief to the small businesses is by providing the Stimulus package. Under this package, stimulus checks would be provided to US adults. On 27th March 2020, President Trump signed the CARES Act into law.

By this Act, cash payments would be provided to adult taxpayers up to $1200 for a single person and up to $2400 for couples. If there is a child, then the amount of the stimulus cheque will include an additional $500.

Those individuals who have earned $75,000 in the adjusted gross income (AGI) on the Income-tax returns of 2018 will be receiving a lower amount. Also, those individuals who do not have a federal tax liability will receive $600 under this proposal.

Deferment of

any amount

The IRS has also announced any amount can be deferred related to the Federal tax. In the Notice 2020-18, the IRS had stated that “there is no limitation on the amount of payment that may be postponed”. Previously, there was a dollar limit on the tax that can be deferred but later on 21st March 2020 this limit has been withdrawn.

This deferment or the postponement of tax payment has only been announced for the federal taxes and is not applicable for any other tax like excise taxes and payroll taxes.

Conclusion

Hence, the various legislations and implementations of new tax laws would be helpful for small business owners to avoid sleepless nights due to tax payments in times of low sales and disrupted business.

References

https://ssfllp.com/coronavirus-covid-19-tax-relief-for-small-businesses/

https://www.patriotsoftware.com/blog/payroll/small-business-relief-coronavirus-pandemic/

Recent Comments