Financial Goals change with change in Income and Taxes as Well

The IRS (Internal Revenue Service) had very recently awarded more than $36 million for the Elderly and Volunteer Income Tax Assistance Grants for those organizations which help in providing senior citizens of the country with federal tax return preparation. Usually, taxes are difficult for everyone; tax returns, tax credit, property tax, social security tax, etc. make the entire concept of taxes even more confusing. With increasing age, the process of tax preparation and tax return seems to be even more difficult.

The complex tax rules, changing technology and the lack of proper funds for hiring a professional tax preparer can make the tax preparation and file even much more difficult. So, if you are ageing and finding it difficult to prepare your federal taxes yourself then you can approach the IRS for assistance.

The IRS offers two great tax preparation programs which the seniors in the country can use:-

Throughout the US, VITA and TCE support centers and programs are located which would be helpful for the seniors. When you visit the IRS website, you would be able to search based on your location that would help you in finding the nearest VITA or TCE program. The IRS would partner with several organizations throughout the US for developing the VITA and TCE programs. These community partners can include faith-based organizations, community centers, non-profit agencies, large employers, etc. Proper training on tax laws and certifications are provided by the IRS to these community partners for enabling them to prepare correct tax returns.

The volunteers at VITA are the IRS certified professionals who help old people or disabled people in their tax preparation. The VITA program by the IRS is most suitable for those seniors who have a particular income which can be subject to income tax. Moreover, the VITA Program is also helpful for those seniors who do not have very fluent English skills, earn a higher income, and need professional assistance for tax preparation. The VITA Program was created in the year 1969 and would help the under-deserved communities like low –income and moderate-income individuals in tax preparation.

The tax professionals at VITA work very hard and help in providing good quality services for the seniors who have low income and would need professional help for the preparation of their tax returns. VITA volunteers would also help in providing counseling on the tax credits that are applicable for reducing the income tax burden. But, there are certain limits on what the VITA volunteers can prepare and cannot prepare. The IRS would suggest that difficult federal tax situations must be handled by paid tax professionals.

Those senior citizens who are not very sure about which tax assistance program they must use can use the TCE Program. The TCE Program was started in 1978 and its volunteers receive proper tax training and technical assistance. According to the laws in 2017, a senior citizen must be 60 years old to qualify for using the TCE Program for tax assistance. Many seniors in the US have a living which is based on a fixed income and they should use the TCE Program rather than the VITA Program.

TCE Program is operated by the IRS certified tax professionals and provides free services to the senior citizens. TCE volunteers make it more convenient for senior citizens by traveling to locations where the seniors can meet them easily such as libraries or community centers, etc. Several non-profit organizations would administer the TCE Program that functions on the grants given by the IRS.

So, senior citizens can avail themselves of professional tax aid programs and also be aware of the tax scams that are a common occurrence these days.

In November 2019, the IRS has announced the annual inflation adjustments for the year 2020. These adjustments would include tax rate schedules and other tax changes. The adjustments of the tax year 2020 would be used while filing the tax returns in 2021. If you are planning for earning more money in 2020 or for changing your circumstances this year, then you should adjust your withholdings or plan for tweaking your payments made for estimated taxes.

The tax items for the year 2020 which would be maximum interest for the taxpayers are:-

So, these are the major tax rules which have been changed in the tax year 2020 which must be understood by the taxpayers.

Since 2016, there is more than $1.5 billion as outstanding refunds with the IRS which remains unclaimed. This implies there might have been more than around one million taxpayers who may be qualifying to obtain tax refunds but did not file their income tax return.

In case, you are due for a tax refund you must file a federal income tax return to obtain your money.

According to the IRS, you have a window of three years within which you can file your tax return and would be able to claim any tax refund which is due. This window of three years begins on the original date when your return was due or the extended due date in case if you had filed for an extension. For the current year, this due date is 15th July 2020 or it is 15th October 2020 if an extension was filed by you.

In case, you miss out on this three-year window you would not be able to get back the money. The money will then belong to the US Treasury and you would have no right to claim the money anymore.

Below-mentioned are the income thresholds for 2016 and if your income for 2016 was below these limits, you would be eligible to obtain ETIC and can be done by filing tax returns by the 15th of July 2020.

To get back your refund, you will need the forms W-2, 1098, 1099 or Form 5498 from the year 2016. In case, you do not have these old forms you can place requests for copies of these forms with your employer, bank, or other payers. You can also the IRS tool i.e. Get Transcript Online tool on the website of the IRS where you would be able to obtain your free wage and income transcript. You might need a copy of the Form 1040, Form 1040A or Form 1040EZ from the year 2016. You can easily obtain these forms and necessary instructions on the IRS.gov Forms and Publications page.

If you have money to be paid back for student loans, any back taxes, or child support then the refund amount would be offset for the tax amount you owe to pay. Moreover, if you have not filed your tax returns for the year 2017 or 2018 then it is quite probable that the IRS would hold back your tax refund.

Hence, this is your chance to claim your refunds back and you should not miss this opportunity failing which the money would belong to the IRS forever.

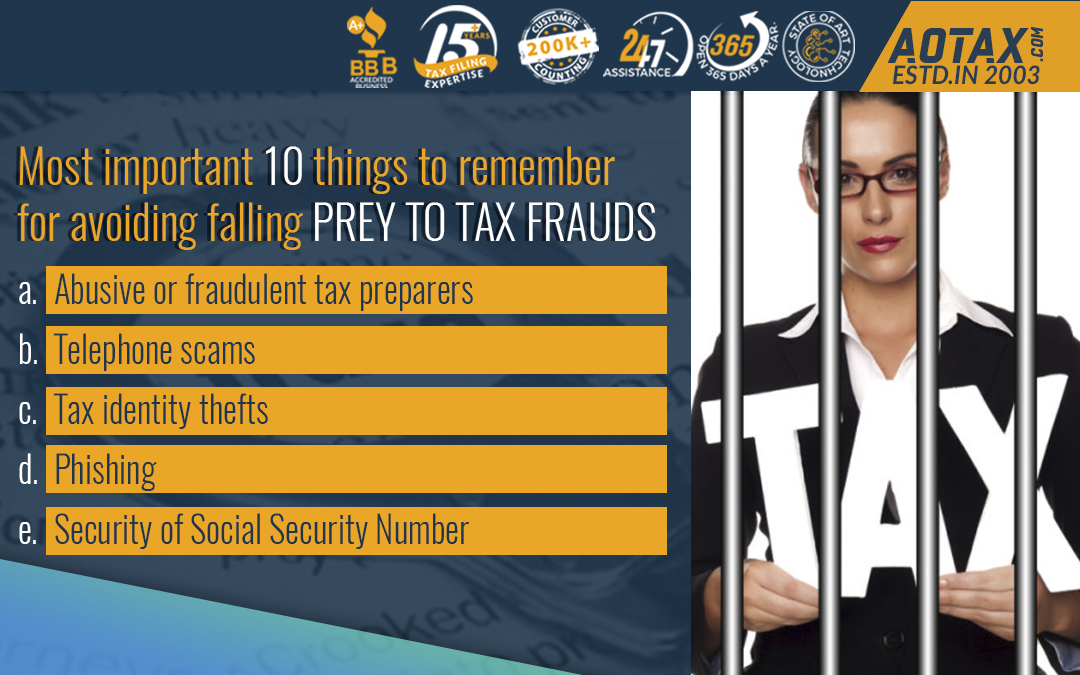

Tax scams are common happening throughout the year. However, with distressful times caused all around by the novel coronavirus tax scammers are finding this as an ideal time for catching up new prey. Usually, it is seen that young Americans are most likely to fall prey to the tax fraudsters and scammers.

The IRS has been continuously creating awareness amongst the Americans against the increased tax scams, frauds, and cons. The IRS has informed the common people about the various in which tax scams can occur may it be in the form of abusive tax schemes, telephone scams, or even in the form of phishing schemes. The IRS urges the Americans to be alert and prevent being a victim to any scams or any such schemes which might be offering instant money or exemption from filing tax returns or paying taxes as the citizen of the United States. Any such schemes or offers can land up common people into big troubles like prosecution and imprisonment as well.

Let us have look at the most important things which need to be kept in mind by the Americans to avoid falling prey to tax scams.

The majority of the tax preparers are quite honest and do the tax preparation legitimately, but some can be fraudulent. Fraudulent tax preparers can file returns by the use of false information to boost the refund. Some taxpayers might even attempt to steal personal information that is present in your tax documents. Taxpayers must be very careful while selecting their tax preparers and must remember that the ultimate responsibility for information used in a tax return is theirs.

This can happen when criminals pose to be IRS agents and call the taxpayers to threaten for paying overdue tax bills. These imposters use fake names and phony IRS identification badge numbers. Taxpayers should always remember that the IRS would never adopt threatening as a strategy to deal with common people. Moreover, the IRS would also never call up taxpayers for immediate payment using a debit card or any other medium. It would usually send you mail in case of any payment due or any other issues.

Tax identity thefts occur when a tax fraudster tend to use taxpayer’s information and obtain income tax returns from the IRS. This might occur even before income tax returns have been filed by the taxpayers. Fraudsters can steal taxpayer’s Social Security number and file returns early in the season. Usually, fraudsters try to use this strategy for deceased persons to obtain the benefits.

Phishing occurs by unsolicited emails or websites posing as legitimate sites that can lure the victims to share their personal and financial information. The intent of the fraudsters here is not to use the taxpayer’s information only for tax-related scams but also to store the information for use in other frauds in the future.

A taxpayer can lose his Social Security number easily and the entire fraud procedure begins when the Social Security Number is available. Taxpayers should avoid carrying Social Security Number outside and must also ensure that their smartphones are locked to avoid Social Security Number theft.

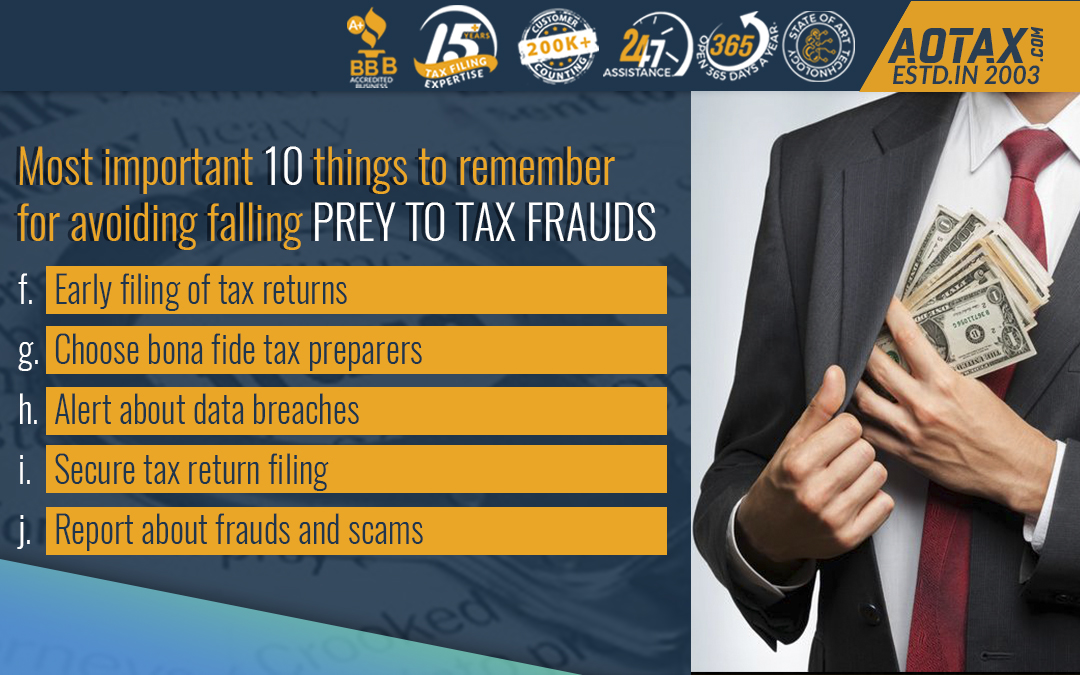

The taxpayers should file their tax returns at the earliest so that they can beat the criminals. Usually, fraudsters aim at filing the tax returns by using the stolen information at the earliest and even obtain the returns before the IRS is aware of it. However, taxpayers can rule out this possibility by filing their tax returns as soon as possible.

Taxpayers must always opt to work with a reputed company and trustworthy tax preparers. Qualified tax preparers would have Tax Preparer Identification Number and taxpayers can check on this from the IRS website. Moreover, taxpayers can check the reviews of the tax preparation companies before deciding to work with them.

Data breaches help the fraudsters in obtaining the information which is needed to execute the tax identity thefts. Sometimes, tax scammers might be having very little information and they can use phishing emails to gain further information. It is very necessary for taxpayers to be aware of data breaches and secure their information in case of any breach.

If taxpayers are filing tax returns using Wi-Fi, they must do it by the use of the secure connection. The filing of tax returns by using public Wi-Fi should be avoided by taxpayers. Moreover, if taxpayers are filing their tax returns by using mail they must do it directly from the post office.

Taxpayers are encouraged to report any fraudulent practice, impersonation scam, phishing scam, etc. to the IRS by using the various tools of the IRS such as IRS Impersonation Scam Reporting, FTC complaint assistant or by sending mail to phishing@irs.gov.

Hence, taxpayers must be very alert about the different types of tax scams that are happening very frequently and must report to the IRS about such scams.

Recent Comments