New to the US – Here’s what you need to know about filing your taxes as an NRI in the US

- Green Card Test

- Substantial Presence Test

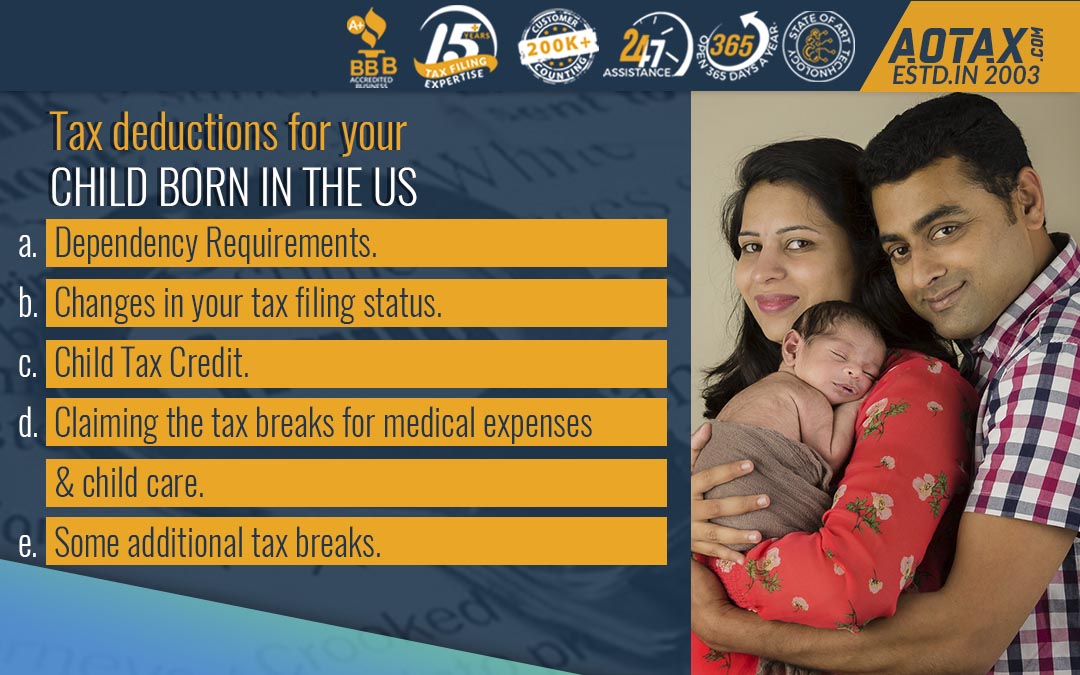

When the deadline for the tax return filing approaches, you should keep your details ready for review so that you do not miss any necessary detail. If you have a kid, then it is feasible that you can obtain some good tax benefits.

If you are going to claim your child as a dependent, then there are certain dependency requirements which your child must meet.

This is considered to be one of the best tax breaks for the parents. You can claim Child Tax Credit up to $1000 for each qualifying child.

Some criteria must be met for your child to be the qualifying child.

There are some other tax breaks which parents can enjoy such as:-

So, these factors would help you to understand the different facets related to the tax deductions associated with your child born in the US.

In March the US Government had declared a $2 trillion economic relief package under the CARES Act for providing relief and support to the Americans who have been facing economic challenges due to the outbreak of the pandemic COVID-19. According to the provisions of the CARES Act, economic impact payments would be sent to the eligible Americans. Furthermore, there are propositions for passing another act i.e. the HEROES Act which would also be providing further another round of economic impact payments to the Americans.

However, with these provisions for Economic Impact Payment to the distressed Americans, many criminal frauds related to these payments have also started blooming. These frauds can include using various lures related to the pandemic and stealing of personal/financial information of common people. The IRS has been continuously reminding the people to safeguard themselves against tax frauds and any other financial scams that are related to the COVID-19 pandemic.

The CI (IRS Criminal Investigation Division) has seen a significant rise in the number of scams and frauds related to the Economic Impact Payments and other financial schemes. The CI has encountered several instances of criminals using emails and text messages which are stimulus-themed to find out personally identifiable information and details related to bank accounts. Many telephone calls or emails have been received by the common people that suggest that they can get more Stimulus money or even obtain the Stimulus money faster by sharing personal information and paying certain processing fees. The phishing schemes send emails or text message which contain terms like “COVID-19”, “Coronavirus”, “Stimulus”, etc. to grab the attention of the common people.

Moreover, the IRS CI has also encountered scams which are related to the selling of fake COVID-19 at-home test kits, vaccines, pills, and other treatment methodologies for COVID-19. Many other scams claim to be selling huge quantities of medical supplies by the creation of fake websites/shops, fake social media accounts, fake emails, etc. These fraud suppliers then fail to deliver the supplies to the customers once the fund has been received by them.

Numerous other COVID-19 related scams involve the creation of fake charities that solicit donations for individuals, groups, and areas which are affected by the pandemic. Many such criminals are also offering opportunities to make investments into those companies which are working on vaccine development for COVID-19. They portray that the company would increase in value as a result and the promotions are put in the form of research reports which make predictions about target price and relate to microcap stocks or the low-cost stocks issued by those companies which are small and have limited public information.

The IRS has been constantly reminding the common people to report any phishing or fraudulent scam encountered by them during the COVID-19.

a. Scams related to COVID-19 must be reported to the National Center for Disaster Fraud (NCDF) Hotline at the number 866-720-5721. The scam can also be reported through the NCDF Web Complaint Form. The NCDF can investigate and prosecute the criminals involved in any scams which are related to natural or any man-made disasters. The Hotline Staff would obtain necessary information related to your complaint which would be further reviewed by the enforcement officials.

b.The taxpayers can also inform any such scams encountered during the COVID-19 to the IRS. Taxpayers receiving unsolicited emails or social media attempts for providing personal information from an organization that appears to be the IRS or closely connected to the IRS must forward those emails to phishing@irs.gov.

c.The Treasury Inspector General for Tax Administration (TIGTA) can help in investigating those external attempts that are being made to interfere with the Federal Tax Administration. Taxpayers can report about COVID-19 scams online by using the link TIPS.TIGTA.gov

d. Taxpayers are suggested to avoid the scammers and not to engage with them even if they think they are in the upper hand.

e.Common people can enhance their knowledge about phishing and fraud related to COVID-19 by visiting the official webpage of IRS i.e. IRS.gov.

Hence, criminals always keep looking for an opportunity by which they would be able to exploit the bad situations and attain some benefits from it. This pandemic COVID-19 is one such opportunity which is being utilized by the scammers. Taxpayers must be aware and should immediately report anything suspicious to the IRS.

The outbreak of the pandemic COVID-19 has brought a tough time for everyone. With the economic lives of people being hugely affected due to the coronavirus, the US Government has taken various steps for providing relief to the Americans.The Coronavirus Stimulus Package under the CARES Act is one such major step taken by the Federal Government which would be of certain help to the Americans for dealing with financial issues arising due to the pandemic.

The Internal Revenue Service (IRS) has been playing a major role in the implementation of the various tax laws which have been passed recently by the Federal Government. Along with the normal course of operational activities of the IRS associated with filing of tax returns and their processing, it is also working tirelessly towards the determination and distribution of the Stimulus payments to the eligible taxpayers.

Let us have a look at the major 10 things which we should know about the operations and working of the IRS during the outbreak of COVID-19.

The official website of the IRS i.e. IRS.gov/coronavirus is the first place where the taxpayers can find answers to all of their queries related to tax returns and stimulus payments.All updates associated with tax returns processing and stimulus package would be posted by the IRS therein this website. The taxpayers should avoid calling up the IRS and check out the IRS.gov/coronavirus website for tax updates amidst the pandemic.

The phone lines of the IRS and the Assistance Centers for taxpayers are to be non-functional for an infinite period.The IRS hotlines including service as well as compliance hotlines such as automated under reporter, collection functions, etc. are not operational for long. Moreover, the IRS has suspended all compliance activities related to tax such as audit and collection till 15th July 2020.So, taxpayers and tax professionals should not worry about missing the tax deadlines. The Local Taxpayer Assistance Centers are also not operational currently.

The IRS has announced that all new audits have been suspended and would resume only after 15th July 2020. But, it is quite obvious for the taxpayers to expect that the IRS must utilize the audit power it has to prevent the erroneous tax refunds.The IRS would be filing filters that would help in stopping suspicious refunds such as Earned Income Tax Credit Returns, suspected identity theft returns, etc. till the taxpayers would be able to verify the returns.So, this freezing of the refund audits will continue and would be troublesome for taxpayers as they will not be receiving any prompt response from the IRS.Moreover, taxpayers can take advice from the local Taxpayer Advocate Service Office in case of facing any queries due to the withholding of audits and refunds.

The IRS has halted the enforcement of any tax collection till 15th July 2020. Moreover, all the pending collection alternatives by the IRS and any offers related to compromises in tax laws are also on hold till 15th July 2020. According to the provisions of the People First Initiative, liens, levies, and any restrictions on passport have also been put on hold.

The IRS would even have its phone lines and hotlines non-functional after the pandemic is over.After the normal operations start, the resources of the IRS would be occupied with the backlog of tax filing issues and people trying to contact the IRS for other tax filing assistance. However, the IRS would be providing other means such as email or e-fax by which taxpayers would submit their documents.

The stimulus payments are being processed by using the information related to the tax returns of 2019 or 2018. If an individual has not filed his tax returns for 2019 or 2018, then this is the right time to do it now. The returns can be e-filed easily and can get accepted in a day without any inconvenience.

Under the provisions of the “People First Initiative”, the IRS has announced that taxpayers can skip their monthly installment payment during the period of 1st April 2020 to 15th July 2020. This would not be considered as a tax payment default by the IRS.

Taxpayers can obtain their transcripts by creating an IRS account online, review these transcripts and get solutions to any queries related to issues like previous AGI, amount of penalty, amount of estimated tax payments, etc.

Any taxpayer facing financial hardships and having a hold on their tax refunds can contact their local advocate for suggestions. However, the central TAS hotline would remain closed.

The IRS has made it clear that it would not use the stimulus payment of any individual for paying off of any tax debt owed by the individual taxpayer.Hence, the IRS is playing a commendable role in helping the common people in improving their economic lives during this difficult time.

https://taxfoundation.org/coronavirus-tax-tracker-covid19/

Due to huge adverse impacts being created by the outbreak of the pandemic COVID-19, social distancing and restrictions on the travel of people residing in the US have been imposed by the US Government. These restrictions imposed on the travel of the people residing in the US are sure to raise queries on the taxation policies and guidelines.

The IRS and the Treasury Department of the US have together issued tax guidelines which would help provide some relief to those people/businesses which have been impacted by these travel restrictions imposed due to COVID-19.

The major highlights of this tax guidance can be listed below.

The Revenue Procedure 2020-20 provides the guidance that under specific circumstances up to a period of 60 consecutive calendar days of presence in the US due to travel disruptions caused because of COVID-19 would not be counted for determination of the US Tax Residency and for other purposes such as qualification for tax treaty benefits for income obtained from the personal services that have been performed in the US.

a.The pandemic COVID-19 has affected the travel plans of many foreign travelers who had planned to leave the US. Even though foreign travelers who test negative for COVID-19 are not being able to leave the US due to cancelation of flights, border closures, and other disruptions.

b.An alien individual would be considered as a US resident for a year under the substantial presence test in the calendar year if

c.Medical condition exception means an alien individual would not be considered as present in the US on those days when he intended to leave the US but was not able to do so due to serious medical condition which arose when the person was in the US.

d.Those individuals who are claiming the Medical Condition Exception need to file the Form 8843, Statement for Exempt Individuals and Individuals with a Medical Condition for filing Form 1040-NR. However, under certain circumstances, the need for timely file Form 8843 might be not taken into consideration.

e.The COVID-19 emergency would be considered as a Medical Condition Exception while determining his eligibility for treaty benefits and revenue procedures. For revenue procedure, an individual would be considered to have intended to leave the country unless he has applied for becoming a resident of the US. Also, for obtaining treaty benefits an individual would be presumed to be unable to leave the country during the period of COVID-19.

The IRS and the Department of Treasury have provided a waiver of the time requirements for revenue procedure and eligibility for treaty benefits. This Revenue procedure provides the qualification for being excluded from gross income under the IRC Section 911 and would not be impacted because of the days spent away from a foreign nation due to COVID-19.

a.A qualified individual can elect to exclude from the gross income of the individual’s foreign earned income and the housing cost amount.

b.The IRS and the Treasury Department have determined that the COVID-19 is an emergency. For IRC Section 911, an individual who had left China on/ after 1st December 2019, or any other foreign nation on/after 1st February 2020, but on/ before 15th July 2020, would be considered as a qualified individual concerning the period during which he was present in, or was a bona fide resident of, that foreign nation if the individual can establish an expectation that he would have met the requirements of the IRC Section 911 for COVID-19 emergency.

c.To qualify for relief for the revenue procedure, an individual must have been physically present, in the foreign nation on/ before the applicable date specified for this revenue procedure. An individual who was physically present or in China after 1st December 2019 or another foreign nation after 1st February 2020 would not be eligible to use this revenue procedure.

d.Individuals trying to qualify for the section 911 foreign earned income exclusion as they have been expected to be present in a foreign country for 330 days for the outbreak of COVID-19 and have met the other 4 requirements for qualification may use any 12 months to meet the qualified individual requirement.

FAQ specifies that specific business activities which are conducted by foreign corporations or by a non-resident alien will not be considered in the 60 consecutive calendar days for determination if the individual or the business is engaged in some US business or has a permanent establishment in the US only if those business activities would not have been conducted in the US due to the travel disruptions caused due to COVID-19.

Hence, these tax guidelines framed by the IRS are also being continuously monitored by the IRS and the Treasury Department. Taxpayers can visit the IRS website and obtain further information related to this.

The US Government has passed and signed a $2 trillion coronavirus bill otherwise known as the CARES Act. This is one of the largest emergency aid packages in the history of the country which has led to most of the taxpayers in the country receiving stimulus checks. These stimulus checks have helped in reducing the plight of the coronavirus affected Americans up to some level.

Along with the provision of all Americans receiving stimulus checks, this bill also includes $500 billion as loans for the struggling businesses, $150 billion for the local and state governments, $377 billion as grants for small businesses and $130 billion for the hospitals which are dealing with a very difficult situation as of now. To date, the IRS has sent around 140 million stimulus checks to the Americans who qualify for receiving the package.

One of the major queries troubling the minds of the common people is what are the qualifying criteria for obtaining the Stimulus package? Are the NRIs living in the US eligible to obtain the Stimulus package or not?

All the US residents qualify to receive the Stimulus package as long as they possess a work-eligible Social Security Number (SSN) and can meet the income specific requirements.

a. The IRS will be determining the eligibility of an individual for the Stimulus package based on his adjusted gross income (AGI) on his 2019 tax return or 2018 tax return if not filed for 2019 yet.

b.The residents of the country who are filing their tax returns as individuals and have an AGI less than $75,000 would receive an amount of $1200 whereas residents who are married and are filing their tax returns jointly having an AGI less than $150,000 would receive an amount of $2400 as Stimulus payment.

c.An additional amount of $500 can be claimed for each dependent child who is below the age of 17 years, has been claimed in the tax returns of 2019 or 2018, and satisfies the other qualifying criterion.

d.Residents of the US who have nontaxable income such as Social Security benefits or Railroad benefits, etc. also qualify for receiving the Stimulus payment. These individuals do not need to file tax returns for obtaining Stimulus payment.

e.Residents filing tax returns as singles and having an AGI in between $75,000 and $99,000 would have their stimulus amount reduced by $5 for each $100 increase in the AGI above $75,000. Similarly, for married couples who have filed their returns jointly and have an AGI above $150,000 will have a reduction of $5 in their stimulus amount for every $100 increase in the AGI above $150,000.

a. The usefulness of the Stimulus payment obtained by the NRIs in the US depends upon various scenarios.

With the impact of the dreadful COVID-19 spreading rapidly across the US, many Americans have lost their jobs and livelihood. Businesses are being closed down and millions of workers across the country have become jobless. The Stimulus package announced by the Federal Government would include a weekly pay boost of $600 which is funded federally for the unemployed along with the regular State unemployment benefits.

However, for the NRIs in the US, there are no provisions to avail of the general state unemployment credit. So, if an NRI in the US loses his job during this pandemic it is difficult for him to manage his finances in the lockdown. The Stimulus package would be the savior for the NRIs at this point and can be used to meet the various financial needs.

b.In case an NRI in the US is into a profession where he would not be able to work from home during the corona times. NRI workers/employees from several industries such as Non-IT, retail, hospitality, restaurants, live entertainment, nightlife, etc. cannot perform their operations from home and thus, experience a partial or complete layoff from work. This would affect the livelihood and finances of the NRIs and the Stimulus checks can be used at this instance.

c.Moreover, since the pandemic COVID-19 is spreading widely across the country; an NRI might experience the situation of his family member or close relative being affected by the disease. In such a scenario, for availing the medical facilities good financial backup is necessary. The amount received by NRIs through the Stimulus package can be utilized for availing good medical facilities for their family members

lhttps://www.forbes.com/sites/advisor/2020/04/28/real-stories-of-filing-for-unemployment-during-covid-19/#7b11b36715dd

https://www.latimes.com/business/story/2020-03-27/who-qualifies-for-the-stimulus

Recent Comments