Filed your 2019 Tax Returns with the IRS? Here’s all you need to know

Filed your 2019 Tax Returns with the IRS? Here’s all you need to know

Under the provisions of the CARES Act, the Americans have been provided with Stimulus payment for certain relief from the economic distress caused due to the pandemic COVID-19. The amount you would receive as Stimulus payment or as the Economic Impact Payment (EIP) is being calculated by the IRS based on the information provided while filing tax returns for the year 2019.

However, there can be instances in which even if the tax returns for 2019 have been filed but the amount received as Economic Impact Payment (EIP) is quite different from the amount expected.

Economic Impact Payment (EIP) is quite different from the amount expected

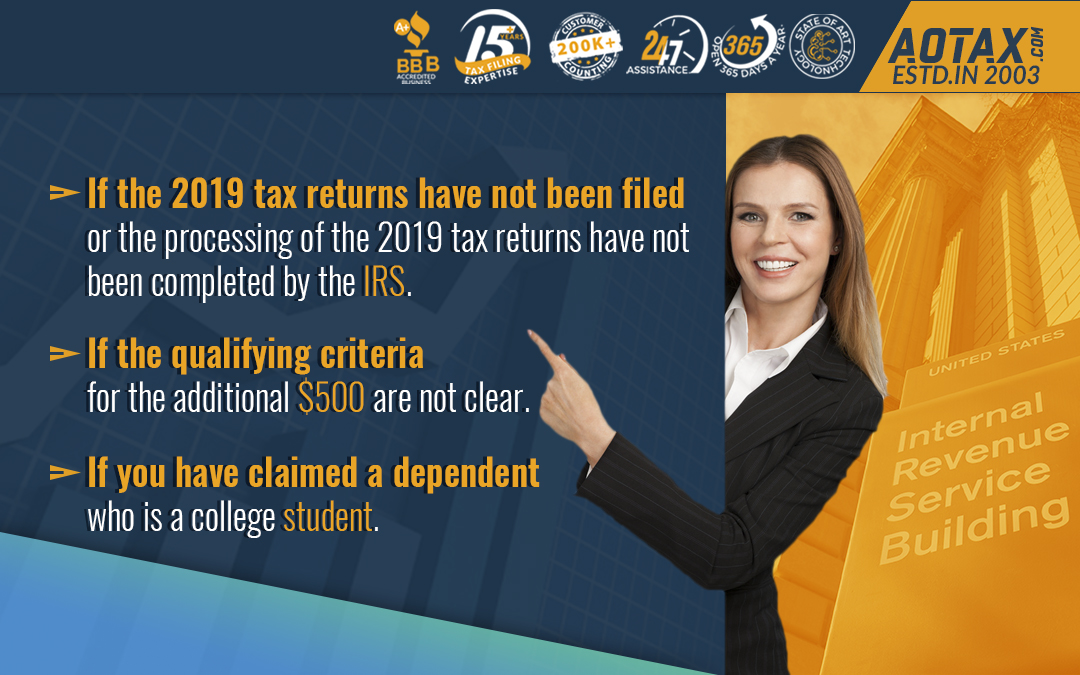

a.If the 2019 tax returns have not been filed or the processing of the 2019 tax returns have not been completed by the IRS

The calculation for the amount you would receive as Economic Impact Payment is done based on their data of 2019. In case you have not filed his tax returns for the year 2019, then in such a case, the IRS would consider the information of the tax returns for the year 2018.

Moreover, suppose you have already filed your tax returns for the year 2019 but the returns have not been processed by the IRS. In such a case, the IRS would use your information of the year 2018 and calculate your EIP. This might lead to receipt of a different amount as the various life events which might have occurred in 2019 would not have been included during the calculation.

b.If the qualifying criteria for the additional $500 are not clear

You would receive an additional $500 if you have claimed your children for the Child Tax Credit during filing your tax returns. To claim a child for the Child Tax Credit, you must be related to the child, lived with him for more than half of a year, and must be bearing half of his expenses. The child must be below the age of 17 years at the end of the year for which you have filed the tax returns.

You can also claim your foster/adopted children, your siblings, your nieces, or nephews if they satisfy the qualifying criteria. If the claimed child has an individual taxpayer identification number (ITIN), then he would not be considered for an additional payment of $500 in the EIP. You would receive an additional $500 only if the claimed dependent has a valid Social Security Number (SSN) or an Adoption Taxpayer Identification Number (ATIN).

c.If you have claimed a dependent who is a college student

According to the CARES Act, if you have claimed your child or dependent who is a college student then you would not be eligible for receiving the additional $500. Suppose, you have claimed your dependent who is a college student in your 2019 federal income tax returns. However, your dependent is more than 17 years of age and would not be eligible for getting you the additional $500 in the EIP.

d.If claimed dependents are above the age of 17 years or are your parents/relatives

In case during your tax return filing, you have claimed your parent or any other relative who is of the age 17 years or older, then that dependent will not be eligible to receive a $1,200 Stimulus payment. Also, you will not be eligible to receive an additional $500 in your EIP because your parent or other relative is not satisfying the qualifying criteria i.e. being above the age of 17 years.

However, if you are not claiming your parent or relative as a dependent and neither anyone else is doing so for their tax return of 2020, then your parent or relative would be eligible to obtain the $1200 stimulus payment on the tax return filed for 2020 next year.

e.If past-due support to a child is deducted from the EIP

Your past-due child support can be a reason for the offset of your EIP. In such a case, if an offset occurs you would receive a notice from the Bureau of the Fiscal Service. In case you are married and have filed your tax returns jointly, along with filing an injured spouse claim during your tax returns of 2019 or 2018(in case the tax returns for 2019 have not been filed) the payment would be equally divided and sent to you and your spouse. Your EIP or your spouse’s EIP would be offset depending on who owes the past-due child support.

If you received an incorrect EIP

- You need to be very clear about the eligibility criteria, know the eligibility requirements of your family, and ensure that you meet the qualifying criteria.

- You might have received a lesser amount of EIP than that you expected. However, you might be eligible to receive an extra amount of EIP next year while filing your tax returns for 2020.

- If you are eligible, you can claim additional credits on your tax returns for the year 2020 while filing for the tax returns.

- You must keep the letter you receive by mail after obtaining your EIP as records for future use.

Recent Comments