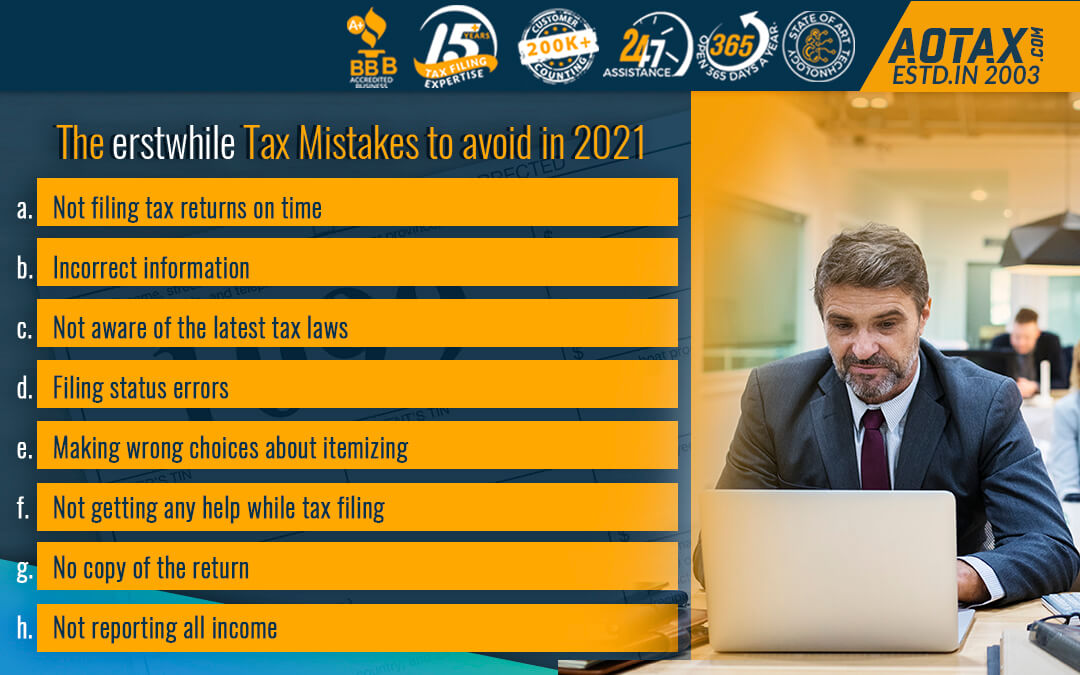

The erstwhile Tax Mistakes to avoid in 2021

The tax laws in the US are quite complicated but the taxpayers make quite simple mistakes while filing their tax returns.

Let us have a look at the most common tax mistakes which are made by the US taxpayers and can be avoided during this tax year.

- Not filing tax returns on time

According to the estimates made by the IRS, 20% of the US taxpayers would wait till the last date for filing their tax returns. However, waiting till this last minute can cause them to miss the deadline. Even if the taxpayers are filing a request for an extension in the deadline to file the tax returns there would be the need to pay any tax that is owed by the actual deadline. In case, the tax payments are not made by the due date then the taxpayer would be charged interest by the IRS.

- Incorrectinformation

This is one of the most common mistakes made by the taxpayers while filing their tax returns. Some of them either leave some boxes blank or some make a typo error while filling important details like Social Security Number.

One of the easiest methods by which you can avoid this is by importing the tax return which has been filed in the previous tax year. By this, you can avoid any typo error associated with manual entry of the filing information.

Not aware of the latest tax laws

The US tax laws are not only complicated but are subject to minor changes every year. It is imperative for the taxpayers to know in detail about the changes that have been made into the tax laws so that they do not miss the details on the tax deductions and credit.

- Filing status errors

The filing status of a taxpayer would determine the tax rate of a taxpayer and his eligibility to avail the tax deductions. If a wrong filing status is being chosen by a taxpayer then he would have to either underpay or overpay the taxes which would have its own implications on the cost. For instance, married couples who are filing tax returns jointly have different rules than those who are filing their returns separately.

Making wrong choices about itemizing

While filing your tax returns, you can either choose between itemizing or claim a Standard deduction. If you are itemizing then you would not be able to claim Standard Deductions. Out of the two, you can choose either one out of the two choices.

There are certain deductions which you can claim easily without the need for any itemizing. These deductions can be making contributions into the IRA or the deduction related to the Student loan interest. However, some deductions can only be claimed if itemized which gives up the right for claiming the Standard Deduction.

- Not getting any help while tax filing

Tax filing is complicated and should not be done on your own. You can take the help of various software programs which are designed with the aim of making tax filing easier and simpler. You can answer a series of simple questions which would help you in identifying your deductions and credits and thus, simplifying your process of filing the returns.

Moreover, taxpayers can also take assistance from tax professionals then it would be a great option to avoid any mistakes while tax filing.

- No copy of the return

Usually, the tax experts and professionals would advise on keeping a copy of the tax return filed for a period of at least two years. That’s a general time period for which the IRS would be able to legally audit the taxpayers for the gross under-reporting of their income.

- Not reporting all income

If taxpayers are not reporting all of their income, then the probabilities are quite high that the IRS would know about them. As the IRS receives forms like Form W-2s and Form 1099S for the entire income you earn, it is quite easier for the IRS to know even if you are not reporting.

The IRS can carry criminal prosecutions for any wrong or non-reporting of income by the taxpayers. Taxpayers can be penalized for the non-reporting of all income and it is always advisable to report the correct income to the IRS.

Conclusion

So, now since the taxpayers have an idea about the erstwhile tax mistakes it is wiser to be careful, avoid these mistakes and rule out the possibilities of being penalized.

Recent Comments